What is Home Equity?

Home equity is the portion of your home’s value that you truly own. It’s the difference between the market value of your property and the outstanding balance of your mortgage. Homeownership, therefore, becomes a powerful tool for building wealth over the long term. As you make monthly mortgage payments, a significant portion goes towards reducing your loan balance, gradually increasing your equity in the property. Additionally, as the real estate market appreciates, the value of your home typically rises over time, further contributing to your home equity.

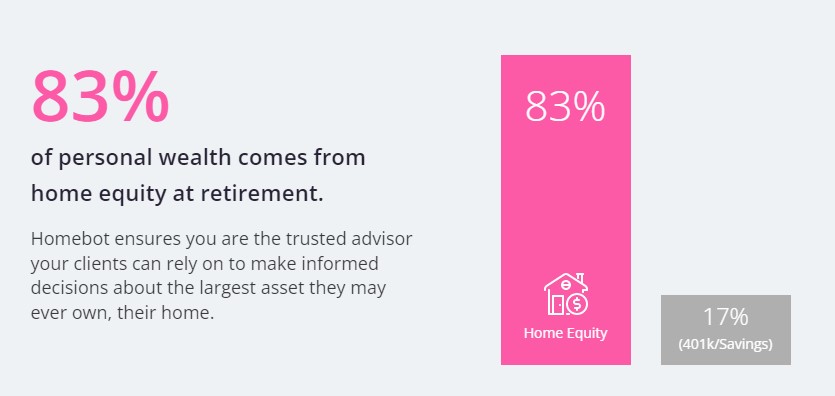

This increase in home equity offers numerous financial benefits for your future. First and foremost, it acts as a forced savings mechanism, promoting financial discipline and wealth accumulation. As your equity grows, you gain access to a valuable asset that can be tapped into through various means, such as home equity loans or lines of credit, to fund major expenses like education, home improvements, or emergencies. Furthermore, home equity can serve as a retirement nest egg, as it allows you to downsize, sell, or borrow against your property when needed.

Monitor Your Home Equity

homebot is a powerful resource to help monitor and build wealth with your home. Enter in a property address below, and with our partnership with homebot, you will receive:

- Personalized home financial data

- Track home value and equity

- Personalized calculations to save you money and pay off your loan earlier.

- Actionable home wealth information